Are Your Finances Mathing?

Navigating 2024: Budgeting Tips and Stress Relief

"Annual income twenty pounds, annual expenditure nineteen pounds nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery." - Charles Dickens

Wow, this year is already off to a busy start! It seems like many of us are feeling the pressure as we juggle our plans, resolutions, and the reality of our financial goals. If you find yourself thinking, "My mathing is not mathing," you're not alone. Managing finances can be a daunting task, but fear not; we're here to help you stay on track.

Revisit Your Resolutions: Start by revisiting your resolutions and financial goals for the year. Make sure they are specific, measurable, achievable, relevant, and time-bound (SMART). Having clear objectives will help you stay focused.

Create a Realistic Budget: A well-structured budget is your best friend when it comes to managing your finances. Take a closer look at your income and expenses. Consider using budgeting apps or spreadsheets to keep track of your spending. Ensure that your budget allows for both savings and fun.

Prioritize Savings: Saving for various goals can feel overwhelming, but it's crucial for your financial well-being. Set up automatic transfers to your savings accounts to ensure you consistently contribute toward your objectives, whether it's an emergency fund, a vacation, or retirement.

Cut Unnecessary Expenses: Review your monthly expenses and identify areas where you can cut back. It could be as simple as cancelling unused subscriptions, cooking at home more often, or reducing impulse purchases.

Seek Financial Advice: If your mathing really isn't mathing, don't hesitate to seek professional financial advice. A financial advisor can help you create a personalized plan and provide insights into investments, tax strategies, and more.

Embrace Stress-Relief Practices: Stress can make budgeting and financial planning more challenging. Explore stress-relief techniques such as meditation, exercise, or hobbies to help you stay calm and focused.

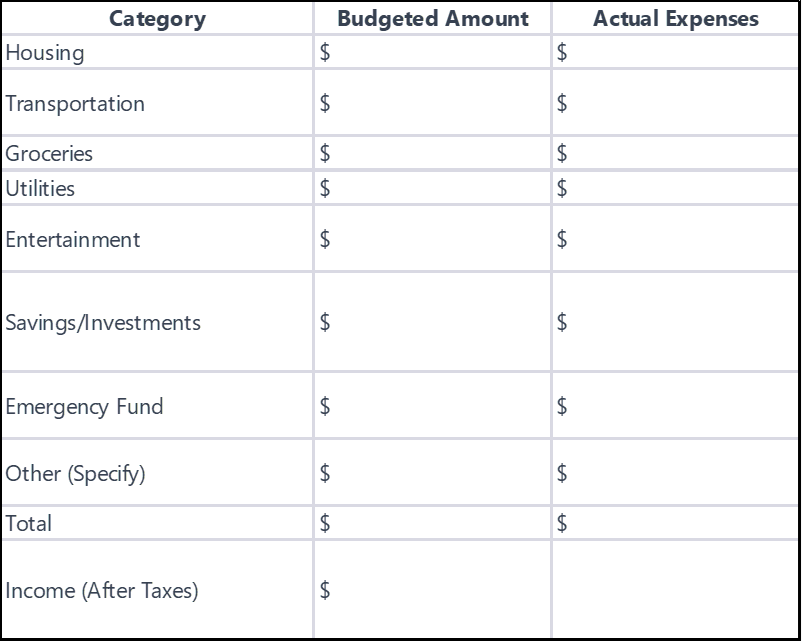

Financial Planning Table:

Here's a simple month to month financial planning table to help you get started:

Remember, this table is a starting point. Customize it to your specific needs and update it regularly to track your progress.

And here's a fun financial fact to wrap things up:

Did you know that the average American spends approximately $1,497 per year on coffee? That's a latte money! Consider brewing your own coffee at home to save some extra cash.

Here's to a successful and less stressful 2024 filled with "mathing" that adds up!